Though I expected to reach this point before Christmas, I completed the first draft of my novel last Wednesday, December 27. It comprises 52 chapters, 80,671 words. I need to write a brief prolog and epilog, as well as an annotated bibliography for those who want to read brilliant accounts of central banking, fiat money, and a market monetary standard.

I'm trying to wait a week before beginning to edit it seriously. I find that very hard to do.

Saturday, December 30, 2006

College Grad

I spent a few hours this afternoon putting together a short movie of my daughter Katie's recent graduation from Armstrong Atlantic University in Savannah, Georgia. I'm using an iMac that is ancient by current standards -- a G4 running at 1 ghz. For software I used iMovie and iDVD version 5. I wish blogger supported the posting of brief video clips, but here's a still from the footage. As you can see she was all smiles and roses.

Wednesday, December 13, 2006

Wikipedia Fixed It Fast

According to conservative columnist Paul Jacob, an academic wanted to demonstrate Wikipedia's vulnerability by introducing deliberate errors in remote sections of the encyclopedia. The academic

Jacob wishes the whole country could be run as well as Wikipedia.

If it had been a government-run database:

1. Only select bureaucrats would have the authority to create and edit material

2. It would be inferior in depth and range of subjects

3. Any topic that interconnected with politics would be subject to political treatment

4. Mistakes would require a form to fill out and submit. The form would be multiplied several times for filing. A copy would be sent to a committee. The committee might hold a meeting to discuss whether the reported mistake is really a mistake. If a consensus was reached that it was, they would hold another meeting to discuss how best to correct it. In time, the mistake would be corrected.

5. The encyclopedia would reflect what the government and its friends wanted, not the taxpaying public.

6. The cost to taxpayers and dollar-holders for maintaining the database would be astronomical and rise each year. Budget cutbacks would affect datbase upkeep, which means reported mistakes might live there forever.

7. To win public support the Department of Education would require all government [public] schools to use the database.

. . . expected the errors to languish for days and weeks and maybe even months, before anyone would notice exactly what he had deliberately snuck into the resource.But Wikipedia's volunteers proved him wrong. "Within three hours, they eradicated each one of his errors . . . and even excoriated him for inventing stuff!"

Jacob wishes the whole country could be run as well as Wikipedia.

If it had been a government-run database:

1. Only select bureaucrats would have the authority to create and edit material

2. It would be inferior in depth and range of subjects

3. Any topic that interconnected with politics would be subject to political treatment

4. Mistakes would require a form to fill out and submit. The form would be multiplied several times for filing. A copy would be sent to a committee. The committee might hold a meeting to discuss whether the reported mistake is really a mistake. If a consensus was reached that it was, they would hold another meeting to discuss how best to correct it. In time, the mistake would be corrected.

5. The encyclopedia would reflect what the government and its friends wanted, not the taxpaying public.

6. The cost to taxpayers and dollar-holders for maintaining the database would be astronomical and rise each year. Budget cutbacks would affect datbase upkeep, which means reported mistakes might live there forever.

7. To win public support the Department of Education would require all government [public] schools to use the database.

Wal-Mart Fights the Fed

Vast numbers of people in this country have cast their vote for Wal-Mart and do so every time they shop there. Let the numbers speak for themselves. If Wal-Mart starts doing things people don't like, such as raising prices, a free market will allow competitors to step in and try to do better. As long as Wal-Mart and other companies don't call on government to protect them from competition, we as consumers will benefit.

Wall Street bankers didn't like the competition they were facing at the turn of the 20th century, so they "partnered" with select politicians and created the Federal Reserve System, the most destructive cartel in human history.

In a very real sense, Wal-Mart is an antidote to Fed counterfeiting. As the Fed erodes the value of the dollar through inflation, Wal-Mart puts some of that value back with attractive prices.

People who want to lay the heavy hand of government on Wal-Mart should consider that they are helping to crush what's left of free enterprise. It is the "free" in "free enterprise" that brings us material benefits.

As Sheldon Richman noted today about New Hampshire's tendency to regulate everything in sight:

"Live free or legislate".

Wall Street bankers didn't like the competition they were facing at the turn of the 20th century, so they "partnered" with select politicians and created the Federal Reserve System, the most destructive cartel in human history.

In a very real sense, Wal-Mart is an antidote to Fed counterfeiting. As the Fed erodes the value of the dollar through inflation, Wal-Mart puts some of that value back with attractive prices.

People who want to lay the heavy hand of government on Wal-Mart should consider that they are helping to crush what's left of free enterprise. It is the "free" in "free enterprise" that brings us material benefits.

As Sheldon Richman noted today about New Hampshire's tendency to regulate everything in sight:

"Live free or legislate".

Thursday, December 7, 2006

Sennholz on Friedman

Hans Sennholz has written extensively on economics issues, largely from an Austrian perspective. Unlike other freedom advocates -- see Sheldon Richman and Jacob Hornberger and Richard Ebeling and Sheldon Richman for examples -- as well as the mainstream media -- see Fox News and The New York Times (registration required) -- Sennholz is not afraid to censure the recently-deceased Milton Friedman for his reckless and naive monetary prescriptions. In a recent commentary on Friedman's passing Sennholz says

According to Richard Ebeling and Sheldon Richman, Friedman

Sennholz, by contrast, points out that

Sennholz claims that Friedman's amendment

More precisely, the amendment would allow a favored few to seize wealth at the stroke of a pen, but his point is well-taken. Sennholz concludes that

Thank you, Hans Sennholz, for bringing these issues to light.

It is strange that Professor Friedman and his fellow monetarists, who are such defenders of the market order, should call on politicians and bureaucrats to provide the most important economic good -- money. Granted, monetarists do not trust them with discretionary powers, which led Friedman to write a detailed prescription, a Constitutional Amendment; however, the Constitution is supreme force, backed by courts and police. The amendment is a political formula to be adopted by political authorities and, when enacted, a constitutional prohibition of monetary freedom.

According to Richard Ebeling and Sheldon Richman, Friedman

argued that it was misguided Federal Reserve policy in the early 1930s that generated the severity of the Great Depression -- and not any inherent failures in the market economy.

This led Friedman to make the case for a "monetary rule," under which the monetary authority would be denied any discretionary powers over the money supply. Instead, the Federal Reserve would be limited to increasing the supply of money at a fixed annual rate of around 3 percent. This would create a high degree of predictability about monetary policy and generate a relatively stable price level in a growing economy.

Sennholz, by contrast, points out that

Contrary to monetarist doctrine, an expansion of the money stock of three to five percent suffices to generate the business cycle. Economic booms and busts occur in every case of fiat expansion, whether the expansion is one percent or hundreds of percents. The magnitude of expansion does not negate its effects; it merely determines the severity of the maladjustment and necessary readjustment.

Monetarists are quick to proclaim that business recessions in general, and the Great Depression in particular, are the result of monetary contraction. Mistaking symptoms for causes, they prescribe policies that treat the symptoms; however, the prescription, which is reinflation, tends to aggravate the maladjustments and delay the necessary readjustment.

Sennholz claims that Friedman's amendment

would create income and wealth with the stroke of a pen, and then distribute the booty to a long line of eager beneficiaries. The amendment would fix the quantity of issue, but the mode of its distribution, which confers favors and assigns losses, would be left to the discretion of the monetary authorities.

More precisely, the amendment would allow a favored few to seize wealth at the stroke of a pen, but his point is well-taken. Sennholz concludes that

What Professor Friedman called the dethroning of gold was, in truth, the default of central banks to make good on their legal and contractual obligations. Following the example set by the United States on August 15, 1971, central banks all defaulted in their duty to redeem their currencies in gold. The default, unfortunately, did not bring stability and prosperity; it opened the gates for world-wide inflation.Milton Friedman had the rhetoric of a free market champion but his monetary recommendations were more on the order of Keynesian-lite. It took a bold man to blame the Fed for the Depression, as Friedman did, but it was a gross blunder to say that the Fed's mistake was not inflating enough. No wonder the Fed's Bernanke honored Friedman on his 90th birthday. In Friedman's world, the Fed was mistaken but not fundamentally wrong.

Thank you, Hans Sennholz, for bringing these issues to light.

Friday, December 1, 2006

"The Public Be Damned!"

Who said it and what does it mean?

The phrase is attributed to William Henry Vanderbilt, railroad magnate, on October 8, 1882. Vanderbilt had just arrived in Chicago from Michigan City, Indiana and was about to eat supper in his private railroad car when a young freelance reporter, Clarence Dresser, invaded his domain and demanded that Vanderbilt give him an immediate interview on the topics of railroad financing and the guidelines used for establishing freight rates.

Vanderbilt said he would talk to him after supper.

Dresser persisted: "But I have a deadline to meet, and the public has a right to know."

Whereupon Vanderbilt uttered his famous four words and told him to get out.

Dresser tried to sell the encounter to the Chicago Daily News, but they turned it down. Then he rewrote the story and sold it to the Tribune. Here is what they printed:

Hatch stated further that

Vanderbilt claimed he worked for himself and his stockholders. If we take "the public" to mean those who pay to use his railroad, how is their welfare served, if at all? According to Ludwig von Mises:

Vanderbilt tried to use political means to eliminate competition. Yet, as John Steele Gordon concluded:

The phrase is attributed to William Henry Vanderbilt, railroad magnate, on October 8, 1882. Vanderbilt had just arrived in Chicago from Michigan City, Indiana and was about to eat supper in his private railroad car when a young freelance reporter, Clarence Dresser, invaded his domain and demanded that Vanderbilt give him an immediate interview on the topics of railroad financing and the guidelines used for establishing freight rates.

Vanderbilt said he would talk to him after supper.

Dresser persisted: "But I have a deadline to meet, and the public has a right to know."

Whereupon Vanderbilt uttered his famous four words and told him to get out.

Dresser tried to sell the encounter to the Chicago Daily News, but they turned it down. Then he rewrote the story and sold it to the Tribune. Here is what they printed:

“Does your limited express [between New York and Chicago] pay?” Dresser asked.Vanderbilt biographer William A. Croffut had another version, published in 1886:

“No, not a bit of it. We only run it because we are forced to do so by the action of the Pennsylvania Road. It doesn’t pay expenses. We would abandon it if it was not for our competitor keeping its train on.”

“But don’t you run it for the public benefit?”

“The public be damned. What does the public care for the railroads except to get as much out of them for as small a consideration as possible. I don’t take any stock in this silly nonsense about working for anybody’s good but our own, because we are not. When we make a move we do it because it is our interest to do so, not because we expect to do somebody else some good. Of course we like to do everything possible for the benefit of humanity in general, but when we do we first see that we are benefiting ourselves. Railroads are not run on sentiment, but on business principles and to pay, and I don’t mean to be egotistic when I say that the roads which I have had anything to do with have generally paid pretty well.”

“Why are you going to stop this fast mail-train?” Dresser asked in this version.On October 17, 1882, Tribune writer Rufus Hatch wrote a piece savaging Vanderbilt. Hatch claims that

“Because it doesn’t pay. I can’t run a train as far as this permanently at a loss.”

“But the public find it very convenient and useful. You ought to accommodate them.”

“The public? How do you know they find it useful? How do you know, or how can I know, that they want it? If they want it, why don’t they patronize it and make it pay? That’s the only test I have of whether a thing is wanted—does it pay? If it doesn’t pay, I suppose it isn’t wanted.”

“Mr. Vanderbilt, are you working for the public or for your stockholders?”

“The public be damned! I am working for my stockholders! If the public want the train, why don’t they support it?”

Mr. Vanderbilt take the position that he has the same right to run his railways on selfish, exacting principles as the private merchant has. He forgets that his rights come from the people, when he says, "The public be damned!"Isn't it nice to know where our rights come from?

Hatch stated further that

When the reporter [Dresser] asked his views on Railroad Commissioners, the despot [Vanderbilt] answered, "They usually have to be bought up, whenever legislation favorable to the road is needed; they are usually ignorant persons."Hatch's hatchet job popularized the four-word response.

"The Railroad Commissioners be damned."

Vanderbilt claimed he worked for himself and his stockholders. If we take "the public" to mean those who pay to use his railroad, how is their welfare served, if at all? According to Ludwig von Mises:

In the capitalist system of society's economic organization the entrepreneurs determine the course of production. In the performance of this function they are unconditionally and totally subject to the sovereignty of the buying public, the consumers. If they fail to produce in the cheapest and best possible way those commodities which the consumers are asking for most urgently, they suffer losses and are finally eliminated from their entrepreneurial position. Other men who know better how to serve the consumers replace them.So when Vanderbilt uttered "the public be damned," was he claiming indifference to his customers' preferences? When he died in 1885 William H. Vanderbilt was one of the richest men in the world. Money, sometimes great fortunes, can be made through political privileges and protections. The same can be achieved without political favors. James J. Hill was one of the 19th century's greatest examples of market success.

Vanderbilt tried to use political means to eliminate competition. Yet, as John Steele Gordon concluded:

. . . William Henry Vanderbilt’s purported words, while hard-nosed and certainly impolitic, are embedded in inescapable economic truth. Both father [Cornelius Vanderbilt] and son [William Vanderbilt] thought the key to success was to seek profits by giving the public good service, but both knew full well that companies that seek to serve the public rather than make a profit will not be around to do either for very long.

Thursday, November 30, 2006

Higgs' Four Stages of Modern U.S. Wars

Robert Higgs published an outstanding essay on war recently called "War Weariness." He asserts that "major U.S. neo-imperialist wars" -- Korea, Vietnam, and Iraq -- move through four stages:

I, upper-echelon plotting; II, outbreak and early combat; III, sustained combat and strategic stalemate; and IV, cessation of combat and workable resolution.Moreover, he notes that

Once the U.S. government goes to war, the public is simply stuck with it, because the public will not actually rebel against the government, and nothing short of rebellion can ensure an affirmative government response to the public’s wishes.Does the recent turnover in Congress give us hope for a better future? Not according to Higgs:

So, in the wake of the recent elections, in which one faction of the War Party has displaced the other in control of Congress, we have scant grounds for expecting a great change of course in the conduct of the Iraq war. The Democrats have announced grand plans to fleece and bully the public in the greater service of the leading special-interest groups that helped to elect them, and the Republicans, eminently pleased to serve as the loyal not-so-opposed opposition, look forward to bipartisan cooperation in logrolling those splendid 1,500-page statutes in which every species of outrage and robbery is declared to be the law of the land. The war will certainly continue, at least for another two years and perhaps for another five or ten. And why not? Only the people at large―those beyond the precincts of the ruling figures and their major supporters―stand to lose, and who really gives a damn about them?Higgs' most recent book is Depression, War, and Cold War: Studies in Political Economy.

Tuesday, November 28, 2006

Andrew Jackson and "the Monster" - Part I

Many historians blame Jackson for causing an undue inflation for his war on the Second Bank of the United States, which he referred to as "the Monster." Jackson vetoed the Bank re-charter and moved the government funds from the Bank to selected state banks. Thus, Arthur M. Sclesinger, Jr., in The Age of Jackson, says Jackson "removed a valuable brake on credit expansion" by destroying the Bank. Even laissez-fiare advocate William Graham Sumner was inconsistent in his analysis. While praising the Jacksonians for putting "a metalic currency high up on [their] banner," he also condemned them for attacking "a great and valuable financial institution." As economic historian Jeffrey Rogers Hummel writes, Sumner, though critical of Bank president Nicholas Biddle, "considered the Bank [on the whole] a successful restraint on the inflationary proclivities of the state banks."

According to Hummel writers who have created the traditional interpretation of the Jacksonian war on the Bank, which blames Jackson and his supporters for the ensuing inflation, have at the core of their analysis an economic theory known as the sound banking doctrine. He explains:

According to Hummel writers who have created the traditional interpretation of the Jacksonian war on the Bank, which blames Jackson and his supporters for the ensuing inflation, have at the core of their analysis an economic theory known as the sound banking doctrine. He explains:

Banks have always issued more notes or depositTo be continued in Part II.

liabilities than they have monetary reserves to

cover. This process is called fractional reserve

banking, and through it, banks create money.

Thus, an ante-bellum bank which issued $1000

in notes with only $100 in specie (gold or silver

bullion and coin) as reserves in its vault, had

created $900 and had a reserve ratio of 10%.

The sound banking doctrine holds that fraction-

al reserve banking is necessary and beneficial

for a prosperous economy. There are insuffici-

ent quantities of gold and silver in existence to

satisfy monetary needs. Money creation by

banks is a needed service. However, monetary

creation can go too far. Banks will overissue

their notes and deposits and reduce their

reserve ratios to dangerous levels if governed

solely by the banker's desire for profit. That leads

to inflation, economic instability, and wildcat

banking. People will drown in a deluge of

unbacked paper money. Therefore, external

checks are necessary to insure that fractional

reserve banking stays within certain limits and

that reserve ratios stay at certain levels, and

government must provide the checks. It can be

seen that this doctrine occupies the middle

ground between the extremes of hard money on

the one hand, and inflationary banking or fiat

money on the other.

Sunday, November 26, 2006

Promises to keep

I'm not a poet though some millions of years ago I won a $0.25 paperback edition of Guys and Dolls for a loony haiku I wrote. Nevertheless I appreciate good poetry, as I admire quality writing of any kind. One of my favorite poems is this classic:

Stopping By Woods on a Snowy EveningAny person engaged in a long project will sympathize with Frost's message. Along with Danielle Steel's explanation of how she turns out so many books -- "there are no miracles, only discipline" -- it's a strong kick in the pants to get moving on my writing.

by Robert Frost

Whose woods these are I think I know.

His house is in the village though;

He will not see me stopping here

To watch his woods fill up with snow.

My little horse must think it queer

To stop without a farmhouse near

Between the woods and frozen lake

The darkest evening of the year.

He gives his harness bells a shake

To ask if there is some mistake.

The only other sound's the sweep

Of easy wind and downy flake.

The woods are lovely, dark and deep.

But I have promises to keep,

And miles to go before I sleep,

And miles to go before I sleep.

Saturday, November 25, 2006

War is a Racket

In the 1930s two-time Medal of Honor winner Marine Major General Smedley Darlington Butler wrote a book called War is a Racket. It opens thusly:

WAR is a racket. It always has been.Further on he wrote:

It is possibly the oldest, easily the most profitable, surely the most vicious. It is the only one international in scope. It is the only one in which the profits are reckoned in dollars and the losses in lives.

A racket is best described, I believe, as something that is not what it seems to the majority of the people. Only a small "inside" group knows what it is about. It is conducted for the benefit of the very few, at the expense of the very many. Out of war a few people make huge fortunes.

Looking back, Woodrow Wilson was re-elected president in 1916 on a platform that he had "kept us out of war" and on the implied promise that he would "keep us out of war." Yet, five months later he asked Congress to declare war on Germany.

In that five-month interval the people had not been asked whether they had changed their minds. The 4,000,000 young men who put on uniforms and marched or sailed away were not asked whether they wanted to go forth to suffer and die.

Then what caused our government to change its mind so suddenly?

Money.

An allied commission, it may be recalled, came over shortly before the war declaration and called on the President. The President summoned a group of advisers. The head of the commission spoke. Stripped of its diplomatic language, this is what he told the President and his group:"There is no use kidding ourselves any longer. The cause of the allies is lost. We now owe you (American bankers, American munitions makers, American manufacturers, American speculators, American exporters) five or six billion dollars.Had secrecy been outlawed as far as war negotiations were concerned, and had the press been invited to be present at that conference, or had radio been available to broadcast the proceedings, America never would have entered the World War. But this conference, like all war discussions, was shrouded in utmost secrecy. When our boys were sent off to war they were told it was a "war to make the world safe for democracy" and a "war to end all wars."

If we lose (and without the help of the United States we must lose) we, England, France and Italy, cannot pay back this money...and Germany won't.

So..."

Friday, November 24, 2006

Friedman and Rothbard

Nobel Laureate Milton Friedman died last week at 94. He was a prolific author and friend of liberty. He was also a friend of the state. The Cato Institute had this to say about Friedman's passing:

Nobel Laureate Milton Friedman died last week at 94. He was a prolific author and friend of liberty. He was also a friend of the state. The Cato Institute had this to say about Friedman's passing:Friedman was widely regarded as the leader of the Chicago School of monetary economics, which stresses the importance of the quantity of money as an instrument of government policy and as a determinant of business cycles and inflation. In addition to his scientific work, Friedman also wrote extensively on public policy, always with primary emphasis on the preservation and extension of individual freedom. Friedman's ideas hugely influenced both the Reagan administration and the Thatcher government in the early 1980s, revolutionized establishment economic thinking across the globe, and have been employed extensively by emerging economies for decades.

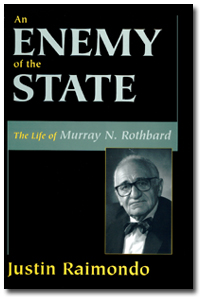

Murray Rothbard was also a prolific author and friend of liberty. When he passed away in 1995 he was 69. In a review today of Justin Raimondo's biography of Rothbard, "Enemy of the State," Mises Institute president Lew Rockwell summarizes Rothbard's views as follows:

Rothbard was the architect of the body of thought known around the world as libertarianism. This radically anti-state political philosophy unites free-market economics, a no-exceptions attachment to private property rights, a profound concern for human liberty, and a love of peace with the conclusion that society should be completely free to develop absent any interference from the state, which can and should be eliminated.

Murray Rothbard was not a friend of the state, nor did he win a Nobel prize.

Thursday, November 23, 2006

Openings

In screenwriting, which I also do, a common mistake of beginners is to begin the story too soon. You've got about 5 minutes to win the audience over, and if the script dawdles with background material you've lost them. Of course, a script like that would never get past the studio reader, who has even less patience than the ticket-buying public. If a screenplay doesn't show promise by the bottom of page one, it's tossed. There are exceptions, but they don't apply to unknown writers.

Another rule of good screenwriting is to have plenty of white space in the script. Before a script is even read it's flipped through to see if there's plenty of air. Too many words and the reader won't even bother with page one.

Now, combine the white space rule with the requirement of hooking the reader by the end of the first page, and you get an idea of how careful a script writer must be with his or her words and scene selections.

Novels can contravene both rules -- they neither have to begin with a punch nor follow the path of tight writing. Yet my personal preference is to get the reader on my side as soon as I can. Here are two novels and their openings that won me over immediately:

1. The Andromeda Strain, Michael Crichton, 1969, fourth paragraph:

"There is something sad, foolish, and human in the image of Shawn leaning against a boulder, propping his arms on it, and holding the binoculars to his eyes. Though cumbersome, the binoculars would at least feel comfortable and familiar in his hands. It would be one of the last familiar sensations before his death."

2. The Chamber, John Grisham, 1994, opening sentence:

"The decision to bomb the office of the radical Jew lawyer was reached with relative ease."

Notice, too, that Grisham opens with a sentence in the passive voice and does so quite effectively.

Of course, one could argue that neither book is an example of great literature, that many engaging and deeply moving stories avoid having to hit readers over the head to get their attention.

Still, I liked these openings and the stories that followed.

Another rule of good screenwriting is to have plenty of white space in the script. Before a script is even read it's flipped through to see if there's plenty of air. Too many words and the reader won't even bother with page one.

Now, combine the white space rule with the requirement of hooking the reader by the end of the first page, and you get an idea of how careful a script writer must be with his or her words and scene selections.

Novels can contravene both rules -- they neither have to begin with a punch nor follow the path of tight writing. Yet my personal preference is to get the reader on my side as soon as I can. Here are two novels and their openings that won me over immediately:

1. The Andromeda Strain, Michael Crichton, 1969, fourth paragraph:

"There is something sad, foolish, and human in the image of Shawn leaning against a boulder, propping his arms on it, and holding the binoculars to his eyes. Though cumbersome, the binoculars would at least feel comfortable and familiar in his hands. It would be one of the last familiar sensations before his death."

2. The Chamber, John Grisham, 1994, opening sentence:

"The decision to bomb the office of the radical Jew lawyer was reached with relative ease."

Notice, too, that Grisham opens with a sentence in the passive voice and does so quite effectively.

Of course, one could argue that neither book is an example of great literature, that many engaging and deeply moving stories avoid having to hit readers over the head to get their attention.

Still, I liked these openings and the stories that followed.

Wednesday, November 22, 2006

The Real Thanksgiving Story

Readers of Thomas DiLorenzo's "How Capitalism Saved America" and libertarians generally will be familiar with this story, but it's worth repeating at least once a year. The following came from the Foundation for Economic Education:

The Real Thanksgiving Story

In the middle of December 1620 the Pilgrims landed at Plymouth Rock, leaving behind the sinfulness of the “old world” to make a “new Jerusalem” in America. Three years later, in November 1623, they had a great feast thanking God for getting them through an earlier famine, and now for a bountiful crop.

What had created the earlier famine and then the bountiful crops? The story is told in the diary of Governor Bradford, who was one of the elders of that early Puritan colony.

At first, they decided to turn their back on all the institutions of the England that had been their home. This included the institution of private property, which they declared to be the basis of greed, averse, and selfishness. Instead, they were determined to live the “Platonic ideal” of collectivism, in which all work would be done in common, with the rewards of their collective efforts evenly divided among the colonists. Farming was done in common, as well as housekeeping and child raising. This was supposed to lead to prosperity and brotherly love.

But their experiment in collectivism did not lead to prosperity or brotherly love. Rather, it created poverty and envy and slothfulness among most of the members of this little society. Here is Bradford’s description of what communism created among the Pilgrims:

“The experience that was had in this common course and condition, tried sundry years and that amongst godly and sober men, may well evince the vanity of that conceit of Plato's and other ancients applauded by some of later times; that the taking away of property and bringing in community into a commonwealth would make them happy and flourishing; as if they were wiser than God. For this community was found to breed much confusion and discontent and retard much employment that would have been to their benefit and comfort. For the young men, that were most able and fit for labor and service, did repine that they should spend their time and strength to work for other men's wives and children without any recompense. The strong… had no more in division of victuals and clothes than he that was weak and not able to do a quarter the other could; this was thought injustice. The aged and graver men to be ranked and equalized in labors everything else, thought it some indignity and disrespect unto them.

“And for men's wives to be commanded to do service for other men, as dressing their meat, washing their clothes, etc., they deemed it a kind of slavery, neither could many husbands well brook it. Upon the point all being to have alike, and all to do alike, they thought themselves in the like condition, and one as good as another; and so, if it did not cut off those relations that God hath set amongst men, yet it did at least much diminish and take off the mutual respects that should be preserved amongst them… Let none object this is men's corruption, and nothing to the course itself. I answer, seeing all men have this corruption in them, God in His wisdom saw another course fitter for them.”

For two years the harvest time failed to bring forth enough to feed the people. Indeed, many starved and many died of famine. Faced with this disaster, the elders of the colony gathered, Governor Bradford tells us, and decided that another year, and they would surely all die and disappear in the wilderness.

Instead, they decided to divide the property and fields of the colony, and gave each family a piece as their own. Whatever they did not use for their own consumption, they had the right to trade away to their neighbors for something they desired instead.

Now, instead of sloth, envy, resentment, and anger among the colonists, there was a great turnaround in their activities. Industry, effort, and joy were now seen in practically all that the men, women and children did. Bradford writes:

“They had very good success, for it made all hands very industrious, so as much more corn was planted than otherwise would have been. The women now went willingly into the field, and took their little ones with them to set corn; which before would allege weakness and inability; whom to have compelled would have been thought great tyranny and oppression…By this time harvest was come, and instead of famine, now God gave them plenty, and the faces of things were changed, to the rejoicing of the hearts of many, for which they blessed God.”

Indeed, their bounty was so great, that they had enough to not only trade among themselves but also with the neighboring Indians in the forest. In November 1623, they had a great feast to which they also invited the Indians. They prepared turkey and corn, and much more, and thanked God for bringing them a bountiful crop. They, therefore, set aside a day of “Thanksgiving.”

So this November 23rd, when we all sit down with our families and friends to enjoy the turkey and the trimmings, let us not forget that we are celebrating the establishment and triumph of capitalism and the spirit of enterprise in America!

HAPPY THANKSGIVING!

The Real Thanksgiving Story

In the middle of December 1620 the Pilgrims landed at Plymouth Rock, leaving behind the sinfulness of the “old world” to make a “new Jerusalem” in America. Three years later, in November 1623, they had a great feast thanking God for getting them through an earlier famine, and now for a bountiful crop.

What had created the earlier famine and then the bountiful crops? The story is told in the diary of Governor Bradford, who was one of the elders of that early Puritan colony.

At first, they decided to turn their back on all the institutions of the England that had been their home. This included the institution of private property, which they declared to be the basis of greed, averse, and selfishness. Instead, they were determined to live the “Platonic ideal” of collectivism, in which all work would be done in common, with the rewards of their collective efforts evenly divided among the colonists. Farming was done in common, as well as housekeeping and child raising. This was supposed to lead to prosperity and brotherly love.

But their experiment in collectivism did not lead to prosperity or brotherly love. Rather, it created poverty and envy and slothfulness among most of the members of this little society. Here is Bradford’s description of what communism created among the Pilgrims:

“The experience that was had in this common course and condition, tried sundry years and that amongst godly and sober men, may well evince the vanity of that conceit of Plato's and other ancients applauded by some of later times; that the taking away of property and bringing in community into a commonwealth would make them happy and flourishing; as if they were wiser than God. For this community was found to breed much confusion and discontent and retard much employment that would have been to their benefit and comfort. For the young men, that were most able and fit for labor and service, did repine that they should spend their time and strength to work for other men's wives and children without any recompense. The strong… had no more in division of victuals and clothes than he that was weak and not able to do a quarter the other could; this was thought injustice. The aged and graver men to be ranked and equalized in labors everything else, thought it some indignity and disrespect unto them.

“And for men's wives to be commanded to do service for other men, as dressing their meat, washing their clothes, etc., they deemed it a kind of slavery, neither could many husbands well brook it. Upon the point all being to have alike, and all to do alike, they thought themselves in the like condition, and one as good as another; and so, if it did not cut off those relations that God hath set amongst men, yet it did at least much diminish and take off the mutual respects that should be preserved amongst them… Let none object this is men's corruption, and nothing to the course itself. I answer, seeing all men have this corruption in them, God in His wisdom saw another course fitter for them.”

For two years the harvest time failed to bring forth enough to feed the people. Indeed, many starved and many died of famine. Faced with this disaster, the elders of the colony gathered, Governor Bradford tells us, and decided that another year, and they would surely all die and disappear in the wilderness.

Instead, they decided to divide the property and fields of the colony, and gave each family a piece as their own. Whatever they did not use for their own consumption, they had the right to trade away to their neighbors for something they desired instead.

Now, instead of sloth, envy, resentment, and anger among the colonists, there was a great turnaround in their activities. Industry, effort, and joy were now seen in practically all that the men, women and children did. Bradford writes:

“They had very good success, for it made all hands very industrious, so as much more corn was planted than otherwise would have been. The women now went willingly into the field, and took their little ones with them to set corn; which before would allege weakness and inability; whom to have compelled would have been thought great tyranny and oppression…By this time harvest was come, and instead of famine, now God gave them plenty, and the faces of things were changed, to the rejoicing of the hearts of many, for which they blessed God.”

Indeed, their bounty was so great, that they had enough to not only trade among themselves but also with the neighboring Indians in the forest. In November 1623, they had a great feast to which they also invited the Indians. They prepared turkey and corn, and much more, and thanked God for bringing them a bountiful crop. They, therefore, set aside a day of “Thanksgiving.”

So this November 23rd, when we all sit down with our families and friends to enjoy the turkey and the trimmings, let us not forget that we are celebrating the establishment and triumph of capitalism and the spirit of enterprise in America!

HAPPY THANKSGIVING!

Tuesday, November 21, 2006

Starting a Blog

I'm finishing a novel and thought I would start a blog. Most of my posts will involve freedom or writing issues. Since I spend a great deal of time with my grandson, Preston, who's 20 months old, I wouldn't be surprised to find an item or two about him on this site, as well.

I write because I feel strongly about the continuing decline of freedom in our lives. The State is the organization responsible for our loss, but who is responsible for the State?

The State exists as a way for some people to get something for nothing "legitimately," which under other circumstances would be called theft. In my novel I address this issue through the venue of our monetary and banking system. We have a fractional-reserve banking system and fiat currency, both supported by the federal government. Control of the banking system lies with the Federal Reserve, which is seen by many people as the country's first line of defense against inflation.

In fact, however, the Fed is the sole cause of inflation in our country. The Fed was foisted upon us in 1913 to protect banks from the crises resulting from their practice of issuing more money substitutes -- paper bills and demand deposits -- than they had gold in reserve. By itself the Fed could not succeed. It had to get rid of gold first, and of course that required government intervention.

Roosevelt severed the dollar's connection to gold domestically in 1933, and Nixon completed the crime in 1971 when he did the same internationally. Like all national currencies, the American dollar is no longer defined in terms of gold and cannot be redeemed for gold coins or bars. The dollar cannot be redeemed for anything. Because gold can't be created at will, it puts a limit on how much a bank can inflate with impunity. With the requirement for gold redemption removed from the dollar, banks could inflate at will.

See the inflation calculator here to see what the Fed's policy of inflation has done to the dollar since 1913.

See this inflation calculator to get a rough estimate of how the dollar fared without the Fed prior to 1913.

From an Alan Greenspan speech, December 19, 2002:

. . . the price level in 1929 was not much different, on net, from what it had been in 1800. But, in the two decades following the abandonment of the gold standard in 1933, the consumer price index in the United States nearly doubled. And, in the four decades after that, prices quintupled. Monetary policy, unleashed from the constraint of domestic gold convertibility, had allowed a persistent overissuance of money.Who is responsible for the "persistent overissuance," Alan? And who got the money that was persistently overissued? And for what purpose was it used?

Subscribe to:

Posts (Atom)

An early George Gershwin song from the musical "Miss 1917"

Today, February 12,2024, marks the 100th anniversary of the debut of George Gershwin's "Rhapsody in Blue" in Aeolian Hall in...

-

The Captains, the Kings, and Taylor Caldwell by George F. Smith Published in Writer’s Yearbook 1980 Copyright, 1979 September, 1938. The ec...

-

Who said it and what does it mean? The phrase is attributed to William Henry Vanderbilt, railroad magnate, on October 8, 1882. Vanderbilt h...